Last Updated on Feb 28, 2020 by James W

Some still think that gold is one of the best investments for this next year. I have serious doubts for many reasons. Here are some of them as well as a strategy to stay diversified and spread your risk.

The main reason gold might lose its luster is that the US economy is recovering. That means capital will flow back into the stock market as well as in US Treasuries. In other words, the US is going to become a safe investment again.

That means less capital to push up the price of gold. A great way to stay diversified is by using silver. That is because there is a better chance that this will be a win-win situation. If gold and the other precious metals rises, that means investors are nervous and need a safe haven.

That means silver will rise with it. But if the world economy improves, that means gold will probably decline. In this case, silver might stay stable. That is because silver is heavily used in industrial processes. If the world economy grows, there will be industrial demand for silver.

Investing in Gold and Silver Stocks

You can invest directly in gold and silver bullion or you can invest in stocks that engage in these precious metals. If you go the equity route, here are some of the companies that are making the most money in this industry by annual net income for the most recent reporting period. (By the way, you should find an investment advisor if you want to incorporate gold and silver into your portfolio.)

Barrick Gold Corporation is on the top of this list. This company brought in a net income of $4.484 billion last year. They are really leveraging the recent popularity of gold investments and the rising prices for this commodity.

Barrick stocks are trading for $48.51 a share. They are a $48.53 billion market cap stock. And they have a P/E ratio of 10.83.

Next on this list of gold stocks that are doing well is Goldcorp Inc. They made $1.88 billion in net income in the most recent annual reporting period. That was on $5.36 billion in revenues. This is a $39 billion stock with a P/E ratio of 22.02. Their closing price was $48.34 a share.

Potentially Undervalued Gold and Silver Stocks

Here are some of the stocks in the gold and silver industry that may potentially be undervalued. The basics of finding value stocks are that they should be strong companies that are underlying the stock. Also, thestock marketshould be pricing the stock lower than what the fundamentals suggest.

Top of this list for gold and silver stocks is Anglo Gold Ashanti Limited (AU). They generated $1.55 billion in net income last year on $6.57 billion in total revenues. Their price to earnings ratio is currently at 11.47. The average P/E ratio for this industry is 19.24.

Gold Fields Limited may also be a good value buy. They made $973 million last year on $5.8 billion in total sales. They have a P/E of 11.70.

One thing to watch out for is the price of gold and silver. Right now, there are good margins because they are selling at premium prices. If the world economy begins to do well and investors start selling their gold and silver, you may have a problem on your hands with some of these stocks. Assuming that the economy will recover, I don’t see these stocks are super long term investments.

Gold Investing – Advice for Novices

If you are new to investing, or even very experienced, gold may be a new concept for you in terms of investing. Here is some general gold investment advice for those who don’t get how this works. To be honest, no one really knows, but here is what there is consensus about.

Gold is usually seen as a hedge for inflation risk. That is because it appreciates faster than inflation over time. It’s the oldest currency there is so there is data for this.

In addition, it is seen as a safe haven investment. That is why everyone flocks to it during recessions and uncertain times.

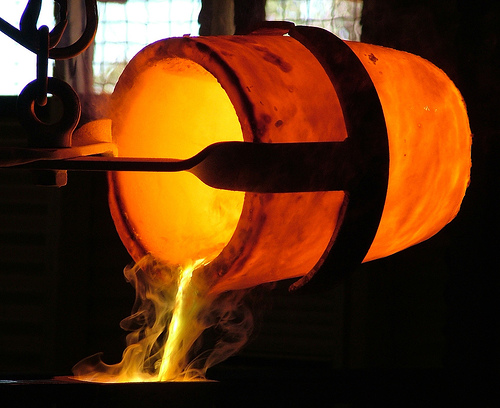

The other thing to know about gold investments are that they don’t have much intrinsic value. There is very little actual use of this metal. Other than some industrial use and for jewelry, it’s essentially an arbitrary piece of metal that looks pretty. But the question is, is it worth $2,000 an ounce?

This is a Guest Post.